The analysis given below on Goldstar's financial state and activity efficiency is made for the period 01.01.2016–31.12.2019 based on the financial statements data prepared according to International Financial Reporting Standards (IFRS).

| Indicator | Value | Change for the period analysed | |||||||

| in thousand USD | % of the balance total | thousand USD (col.6-col.2) |

± % ((col.6-col.2) : col.2) |

||||||

| 31.12.2015 | 31.12.2016 | 31.12.2017 | 31.12.2018 | 31.12.2019 | at the beginning of the period analysed (31.12.2015) |

at the end of the period analysed (31.12.2019) |

|||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Assets | |||||||||

| 1. Non-current assets | 1,883,705 | 1,980,974 | 6,418,308 | 9,590,636 | 18,818,719 | 7.3 | 29.2 | +16,935,014 | +10 times |

| 2. Current assets, total | 24,060,610 | 28,404,067 | 24,799,692 | 47,575,622 | 45,523,022 | 92.7 | 70.8 | +21,462,412 | +89.2 |

| 800,217 | 800,924 | 945,317 | 1,371,705 | 1,876,932 | 3.1 | 2.9 | +1,076,715 | +134.6 | |

| 15,065,072 | 14,855,818 | 12,438,165 | 10,548,676 | 11,019,898 | 58.1 | 17.1 | -4,045,174 | -26.9 | |

| 8,162,804 | 12,729,629 | 11,408,002 | 35,649,452 | 32,617,349 | 31.5 | 50.7 | +24,454,545 | +4 times | |

| Equity and Liabilities | |||||||||

| 1. Equity | 3,645,110 | 4,159,709 | 5,626,672 | 8,507,236 | 12,826,056 | 14 | 19.9 | +9,180,946 | +3.5 times |

| 2. Non-current liabilities | 6,349,695 | 7,803,917 | 2,774,183 | 21,000,000 | 20,000,000 | 24.5 | 31.1 | +13,650,305 | +3.1 times |

| 3. Current liabilities | 15,949,510 | 18,421,415 | 22,817,145 | 27,659,022 | 31,515,685 | 61.5 | 49 | +15,566,175 | +97.6 |

| Assets; Equity and Liabilities | 25,944,315 | 30,385,041 | 31,218,000 | 57,166,258 | 64,341,741 | 100 | 100 | +38,397,426 | +148 |

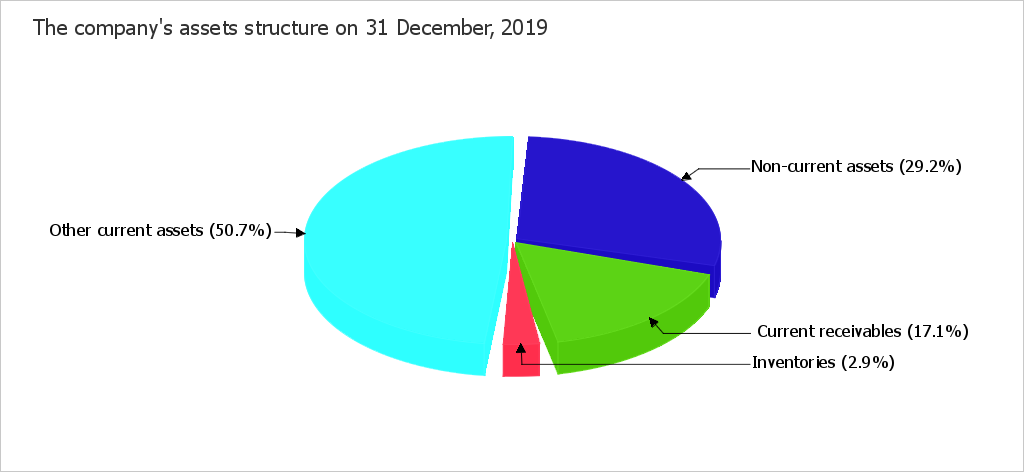

According to the data given in the table, the share of non-current assets makes about one third (29.2%) on 31 December, 2019, while current assets take two thirds, respectively. Such correlation is typical for the activity types where considerable investing of fixed assets and long-term investments are not required but where stocks of raw materials, supplies and goods are plentiful. During the last 4 years, it was seen that there was a very strong increase in the assets of 148% (to USD 64,341,741 thousand). At the same time, equity has grown even more (by +3.5 times during the entire period reviewed). An outrunning increase in equity relative to a total change in assets should be considered as a positive factor.

The increase in total assets of Goldstar occurred due to the growth of the following asset types (amount of change and percentage of this change relative to the total assets growth are shown below):

At the same time, the most significant growth was seen on the following positions in the section "Equity and Liabilities" of the company's balance sheet (the percentage from total equity and liabilities change is shown in brackets):

The most significantly changed items on the balance sheet for the period reviewed (from 31 December, 2015 to 31 December, 2019) are "Trade and other current receivables" in assets and "Other reserves" in sources of finance (USD -4,045,174 thousand and USD -193,887 thousand, respectively).

In the chart below, you will see a correlation of the basic groups of the company's assets.

The inventories grew rapidly by 134.6% and equaled USD 1,876,932 thousand for the 4 years.

During the 4 years, it was seen that there was a notable reduction in the current receivables of USD 4,045,174 thousand, or of 26.9%.

| Indicator | Value | Change | |||||||

| in thousand USD | % of the balance total | thousand USD (col.3-col.2), |

%, ((col.3 -col.2) : col.2) | ||||||

| at the beginning of the period analysed (31.12.2015) | at the end of the period analysed (31.12.2019) | 31.12.2015 | 31.12.2016 | 31.12.2017 | 31.12.2018 | 31.12.2019 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

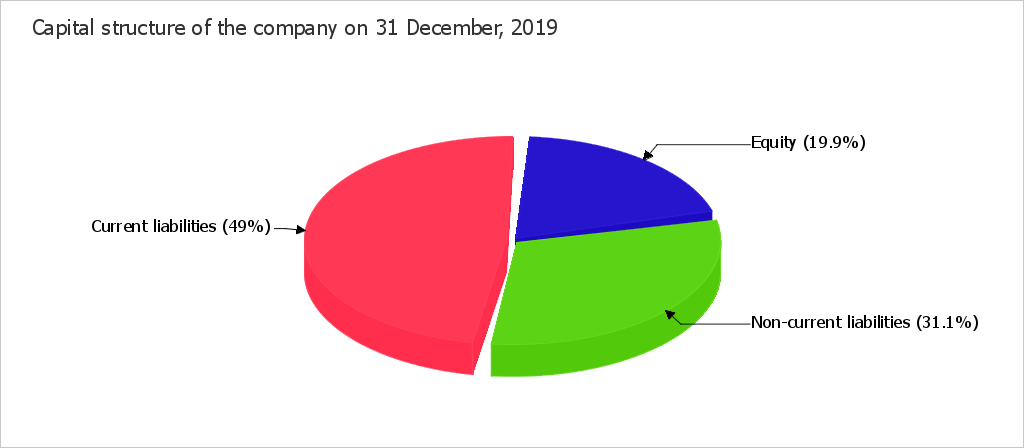

| 1. Net tangible assets | 3,641,757 | 12,757,895 | 14 | 13.7 | 18 | 14.9 | 19.8 | +9,116,138 | +3.5 times |

| 2. Net assets (Net worth) | 3,645,110 | 12,826,056 | 14 | 13.7 | 18 | 14.9 | 19.9 | +9,180,946 | +3.5 times |

| 3. Issued (share) capital | 102 | 204,134 | <0.1 | 0.7 | 0.7 | 0.4 | 0.3 | +204,032 | +2,001.3 times |

| 4. Difference between net assets and Issued (share) capital (line 2 - line 3) | 3,645,008 | 12,621,922 | 14 | 13 | 17.4 | 14.5 | 19.6 | +8,976,914 | +3.5 times |

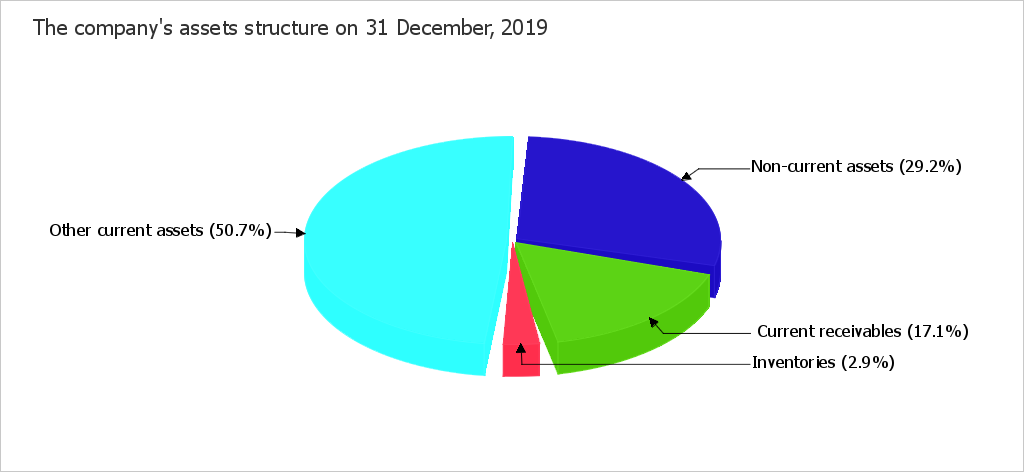

The net tangible assets were equal to USD 12,757,895 thousand on 31.12.2019. During the 4 years, the net tangible assets were observed to increase significantly by 3.5 times. The intangible assets were equal to USD 68,161 thousand at the end of the period analysed. This value shows the difference between the value of net tangible assets and all net worth.

The net worth (net assets) of Goldstar was much higher (by 62.8 times) than the share capital on 31 December, 2019. Such a ratio positively describes the company's financial position. The net worth (net assets) value is used as one of the tools to estimate the company's value (used together with other methods, such as discounted cash flow method, or an estimation based on shareholder's value etc.). But it is a key value in the estimation of the company's financial condition.

During the period, considerable growth in the issued (share) capital was verified.

| Ratio | Value | Change (col.6-col.2) |

Description of the ratio and its recommended value | ||||

| 31.12.2015 | 31.12.2016 | 31.12.2017 | 31.12.2018 | 31.12.2019 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Debt-to-equity ratio (financial leverage) | 6.12 | 6.3 | 4.55 | 5.72 | 4.02 | -2.1 | A debt-to-equity ratio is calculated by taking the total liabilities and dividing it by shareholders' equity. It is a key financial ratio and is used as a standard for judging a company's financial standing. Acceptable value: 1.5 or less (optimum 0.43-1). |

| Debt ratio (debt to assets ratio) | 0.86 | 0.86 | 0.82 | 0.85 | 0.8 | -0.06 | A debt ratio is calculated by dividing total liabilities (i.e. long-term and short-term liabilities) by total assets. It shows how much the company relies on debt to finance assets (similar to debt-to-equity ratio). Normal value: 0.6 or less (optimum 0.3-0.5). |

| Long-term debt to Equity | 1.74 | 1.88 | 0.49 | 2.47 | 1.56 | -0.18 | This ratio is calculated by dividing long-term (non-current) liabilities by equity. |

| Non-current assets to Net worth | 0.52 | 0.48 | 1.14 | 1.13 | 1.47 | +0.95 | This ratio is calculated by dividing long-term (non-current) assets by net worth (equity) and measures the extent of a company's investment in low-liquidity non-current assets. This ratio is important for comparison analysis because it's less dependent on industry (structure of company's assets) than debt ratio and debt-to-equity ratio. Acceptable value: no more than 1.25. |

| Capitalization ratio | 0.64 | 0.65 | 0.33 | 0.71 | 0.61 | -0.03 | Calculated by dividing non-current liabilities by the sum of equity and non-current liabilities. |

| Fixed assets to Net worth | 0.31 | 0.07 | 0.04 | 0.03 | 0.61 | +0.3 | This ratio indicates the extent to which the owners' cash is frozen in the form of fixed assets, such as property, plant, and equipment, investment property and non-current biological assets. Acceptable value: no more than 0.75. |

| Current liability ratio | 0.72 | 0.7 | 0.89 | 0.57 | 0.61 | -0.11 | Current liability ratio is calculated by dividing current liabilities by total (i.e. current and non-current) liabilities. |

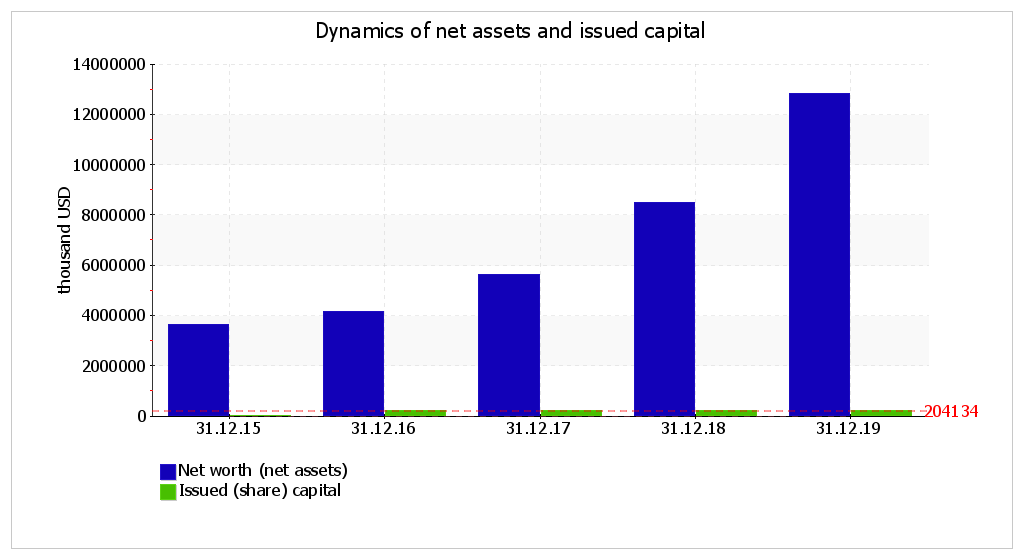

First, attention should be drawn to the debt-to-equity ratio and debt ratio as the ratios describing the capital structure. Both ratios have similar meaning and indicate if there is not enough capital (equity) for stable work for the company. Debt-to-equity ratio is calculated as a relationship of the borrowed capital (liabilities) to the equity, while debt ratio is calculated as a relationship of the liabilities to the overall capital (i.e. the sum of equity and liabilities).

At the end of the period, the debt-to-equity amounted to 4.02. The debt ratio amounted to 0.8 on 31 December, 2019. During the entire period reviewed, the debt ratio dropped noticeably (by 0.06).

The value of the debt ratio negatively describes the financial position of Goldstar on 31 December, 2019, the percentage of liabilities is too high and equaled 80.1% of the company's total capital. The maximum acceptable percentage is 60%. Too higher dependence from creditors can lower the financial stability of the company, especially in the case of economic instability and crisis on the market of borrowed capital. It is recommended to keep the value of the debt ratio at a level of no more than 0.6 (optimum 0.3-0.5). The values of the debt ratio were not acceptable during the whole of the analysed period.

In the chart below, the correlation of the company's equity and liabilities is demonstrated:

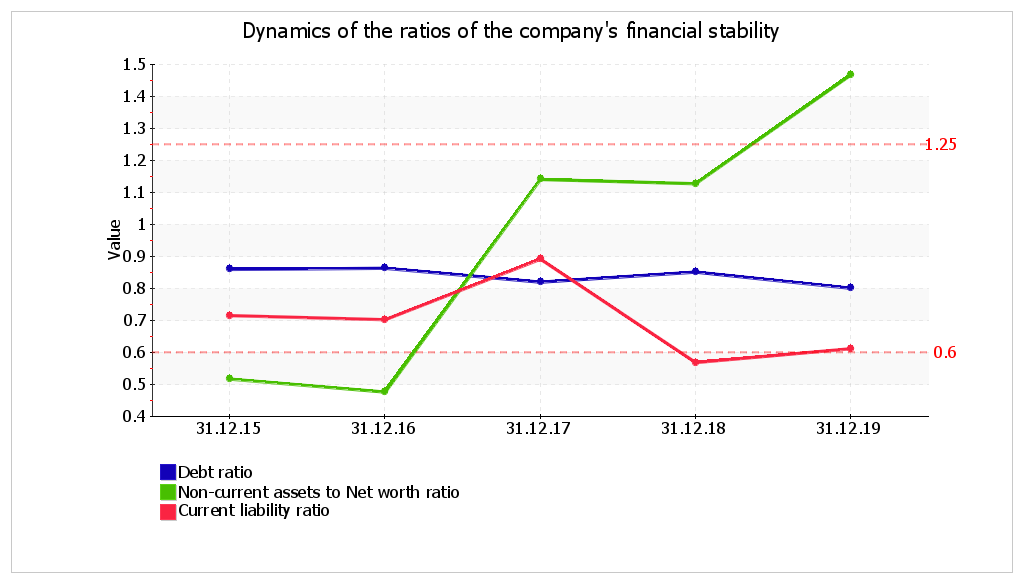

According to common rules, non-current investments should be made, in the first place, with the help of the most stable source of financing, i.e. with the help of own capital (equity). The non-current assets to Net worth ratio shows if this rule is followed. The ratio amounted to 1.47 at the end of the period analysed, which is much higher (+0.95) than at the beginning of the period analysed (31.12.2015). The value of the ratio is unacceptable on 31 December, 2019.

The current liability ratio shows that the share of short-term and long-term liabilities of total liabilities of Goldstar were 61.2% and 38.8% respectively at the end of the period analysed.

The following chart demonstrates the dynamics of the main ratios of financial stability of Goldstar.

| Indicator | Value | Change for the period analysed | |||||

| 31.12.2015 | 31.12.2016 | 31.12.2017 | 31.12.2018 | 31.12.2019 | (col.6-col.2) | % ((col.6-col.2) : col.2) |

|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

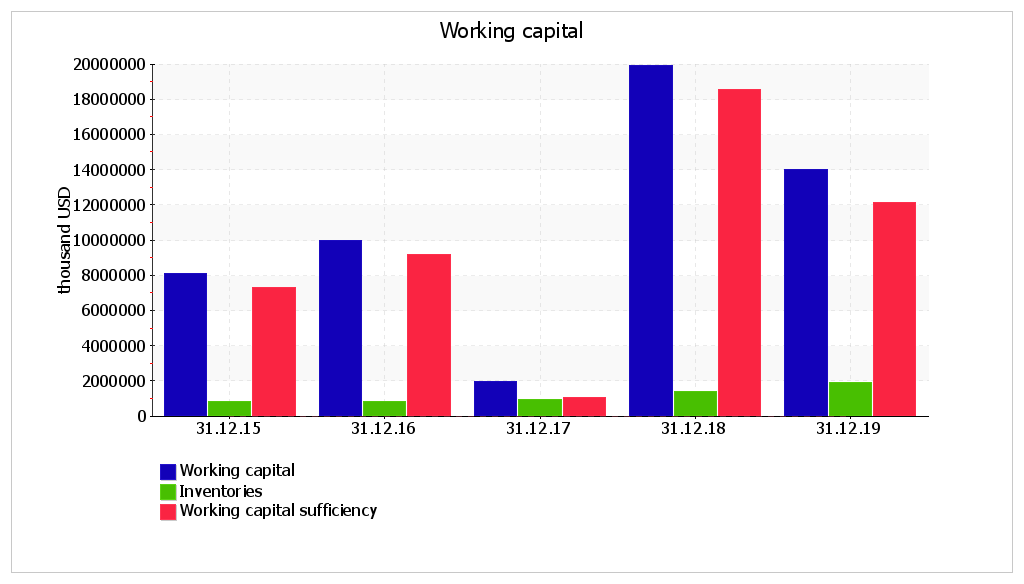

| 1. Working capital (net working capital), thousand USD | +8,111,100 | +9,982,652 | +1,982,547 | +19,916,600 | +14,007,337 | +5,896,237 | +72.7 |

| 2. Inventories, thousand USD | +800,217 | +800,924 | +945,317 | +1,371,705 | +1,876,932 | +1,076,715 | +134.6 |

| 3. Working capital sufficiency (1-2), thousand USD | +7,310,883 | +9,181,728 | +1,037,230 | +18,544,895 | +12,130,405 | +4,819,522 | +65.9 |

| 4. Inventory to working capital ratio (2:1) Acceptable value: 1 or less. | 0.1 | 0.08 | 0.48 | 0.07 | 0.13 | +0.04 | x |

The working capital spiked rapidly by USD 5,896,237 thousand, or by 73% and showed USD 14,007,337 thousand during the entire period reviewed. The table above shows that working capital exceeds the company's inventories by USD 12,130,405 thousand. On 31 December, 2019, the inventory to working capital ratio equaled 0.13. Such a correlation is deemed to be normal, although it can be achieved through warehouse inventories that are too low, but not through enough of long-term resources of financing in some cases.

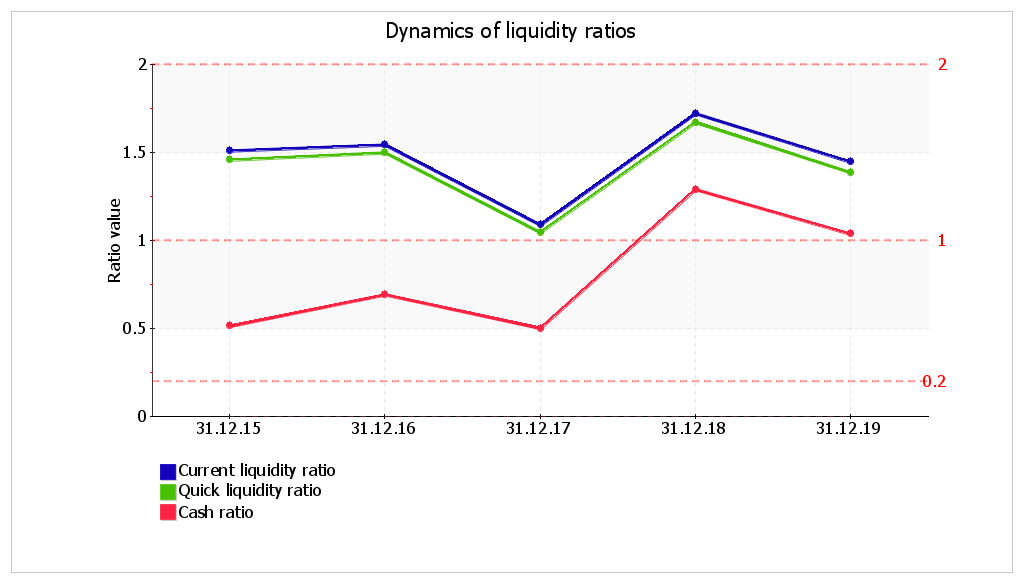

One of the most widespread indicators of a company's solvency are liquidity related ratios. There are three liquidity related ratios: current ratio, quick ratio and cash ratio. Current ratio is one of the most widespread and shows to what degree the current assets of the company are meeting the current liabilities. The solvency of the company in the near future is described with the quick ratio which reflects if there are enough fund's for normal execution of current transactions with creditors. Current ratio, quick ratio and cash ratio for Goldstar are calculated in the following table.

| Liquidity ratio | Value | Change (col.6 - col.2) |

Description of the ratio and its recommended value | ||||

| 31.12.2015 | 31.12.2016 | 31.12.2017 | 31.12.2018 | 31.12.2019 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. Current ratio (working capital ratio) | 1.51 | 1.54 | 1.09 | 1.72 | 1.44 | -0.07 | The current ratio is calculated by dividing current assets by current liabilities. It indicates a company's ability to meet short-term debt obligations. Normal value: no less than 2. |

| 2. Quick ratio (acid-test ratio) | 1.46 | 1.5 | 1.05 | 1.67 | 1.38 | -0.08 | The quick ratio is calculated by dividing liquid assets (cash and cash equivalents, trade and other current receivables, other current financial assets) by current liabilities. It is a measure of a company's ability to meet its short-term obligations using its most liquid assets (near cash or quick assets). Normal value: 1 or more. |

| 3. Cash ratio | 0.51 | 0.69 | 0.5 | 1.29 | 1.03 | +0.52 | Cash ratio is calculated by dividing absolute liquid assets (cash and cash equivalents) by current liabilities.

Acceptable value: 0.2 or more. |

For the last 4 years, it was observed that there was an unimportant reduction in the current ratio from 1.51 to 1.44. On 31 December, 2019, the value of the ratio is not a normal one. During the whole of the period, the current ratio kept a value outside the acceptable range.

On the last day of the period analysed, the quick ratio was equal to 1.38. The quick ratio moderately decreased (by 0.08) during the entire period reviewed. During the analysed period, the ratio changed multidirectionally. At the end of the period reviewed, the value of the quick ratio is very good. It means that Goldstar has enough liquid assets (cash and other assets which can be rapidly sold) to meet all their current liabilities.

On the last day of the period analysed, the value of the cash ratio (1.03) can be described as absolutely normal. On 31.12.2019, the cash ratio equaled 1.03. The cash ratio sharply increased (+0.52) for the entire period analysed.

The main financial results of Goldstar's activities are given in the table below during the period reviewed (from 31 December, 2015 to 31 December, 2019).

| Indicator | Value, thousand USD | Change | Average annual value, thousand USD |

||||

| 2016 | 2017 | 2018 | 2019 | thousand USD (col.5 - col.2) |

± % (5-2) : 2 |

||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. Revenue | 82,214,521 | 108,110,823 | 117,722,498 | 145,103,322 | +62,888,801 | +76.5 | 113,287,791 |

| 2. Cost of sales | 74,225,873 | 97,126,594 | 104,783,784 | 133,343,182 | +59,117,309 | +79.6 | 102,369,858 |

| 3.Gross profit (1-2) | 7,988,648 | 10,984,229 | 12,938,714 | 11,760,140 | +3,771,492 | +47.2 | 10,917,933 |

| 4. Other income and expenses, except Finance costs | -5,879,306 | -5,917,133 | -5,838,352 | -3,355,421 | +2,523,885 | ↑ | -5,247,553 |

| 5. EBIT (3+4) | 2,109,342 | 5,067,096 | 7,100,362 | 8,404,719 | +6,295,377 | +4 times | 5,670,380 |

| 6. Finance costs | 776,175 | 598,864 | 894,442 | 1,770,864 | +994,689 | +128.2 | 1,010,086 |

| 7. Income tax expense (from continuing operations) | 410,271 | 1,572,251 | 1,774,059 | 1,178,563 | +768,292 | +187.3 | 1,233,786 |

| 8. Profit (loss) from continuing operations (5-6-7) | 922,896 | 2,895,981 | 4,431,861 | 5,455,292 | +4,532,396 | +5.9 times | 3,426,508 |

| 9. Profit (loss) from discontinued operations | – | – | – | – | – | – | – |

| 10. Profit (loss) (8+9) | 922,896 | 2,895,981 | 4,431,861 | 5,455,292 | +4,532,396 | +5.9 times | 3,426,508 |

| 11. Other comprehensive income | – | – | – | – | – | – | – |

| 12. Comprehensive income (10+11) |

922,896 | 2,895,981 | 4,431,861 | 5,455,292 | +4,532,396 | +5.9 times | 3,426,508 |

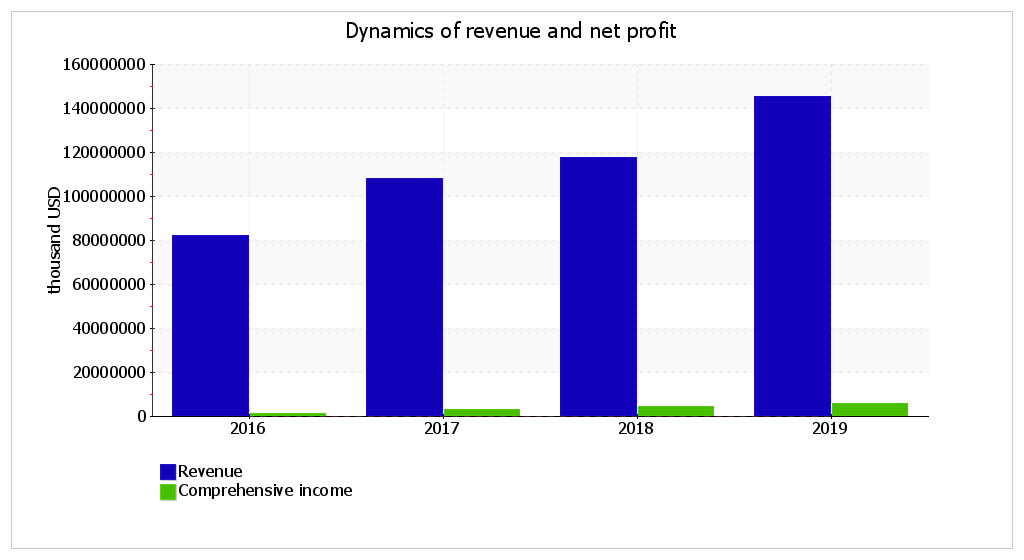

The revenue was USD 145,103,322 thousand during the last year. That is much higher (USD +62,888,801 thousand) than for the period 01.01–31.12.2016. During the whole of the reviewed period the revenue constantly spiked. The change in revenue is demonstrated on the chart. During the last year, the gross profit was equal to USD 11,760,140 thousand. The gross profit significantly increased (by USD 3,771,492 thousand, or by 47.2%) for the whole period analysed.

For the year 2019, the company posted a gross profit and earnings before interest and taxes (EBIT), which was USD 8,404,719 thousand. The final comprehensive income for Goldstar was USD 5,455,292 thousand during the year 2019.

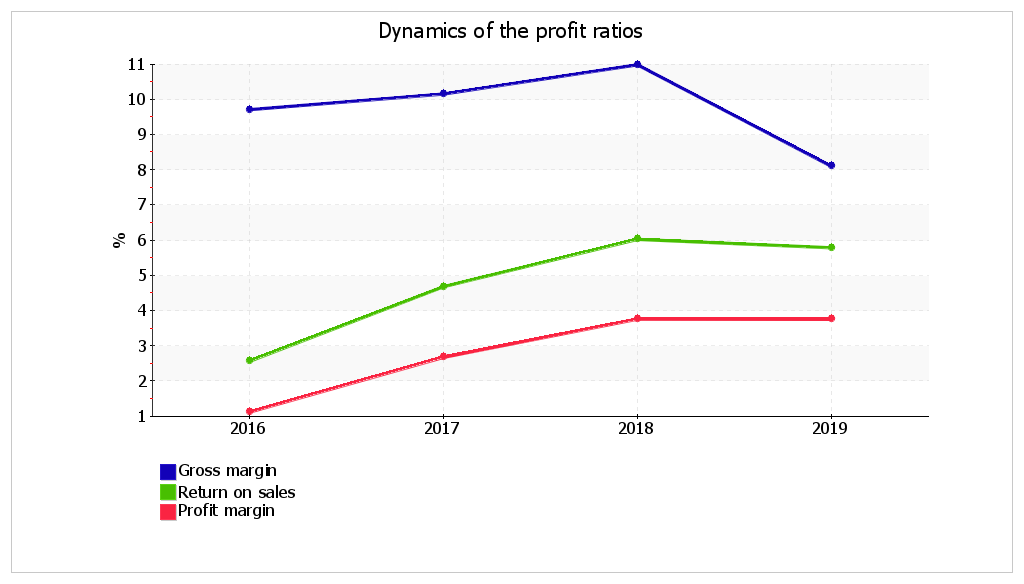

| Profitability ratios | Value in % | Change (col.5 - col.2) |

|||

| 2016 | 2017 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. Gross margin. | 9.7 | 10.2 | 11 | 8.1 | -1.6 |

| 2. Return on sales (operating margin). | 2.6 | 4.7 | 6 | 5.8 | +3.2 |

| 3. Profit margin. | 1.1 | 2.7 | 3.8 | 3.8 | +2.7 |

| Reference: Interest coverage ratio (ICR). Acceptable value: no less than 1.5. |

2.7 | 8.5 | 7.9 | 4.7 | +2 |

For the last year, the company gained gross profit and profit from operational and financial activities, which became a reason for positive values of all three profitability ratios given in the table for this period. During the year 2019, the gross margin equaled 8.1%. The gross margin decreased by 1.6% during the entire period reviewed, additionally, tendency of the gross margin to drop is also confirmed by an average (linear) trend.

The profitability calculated by earnings before interest and taxes (Return on sales) is more important from a comparative analyses point of view. For the last year, the return on sales was 0.06 (or 5.8% per annum), and profitability calculated by net profit was 3.8% per annum.

To assess the liabilities that the company should repay for the use of borrowed capital, an interest coverage ratio was calculated. The acceptable value is deemed to be not less than 1.5. In this case, the interest coverage ratio was 4.7 for the year 2019, which is evidence of Goldstar's capability to pay interest on borrowed assets. It should also be mentioned that not all interest payments are necessarily included on the income statement and used to calculate the indicated ratio. Interest related to investments in qualified assets is not included in the financial results (they are taken into account in the asset value).

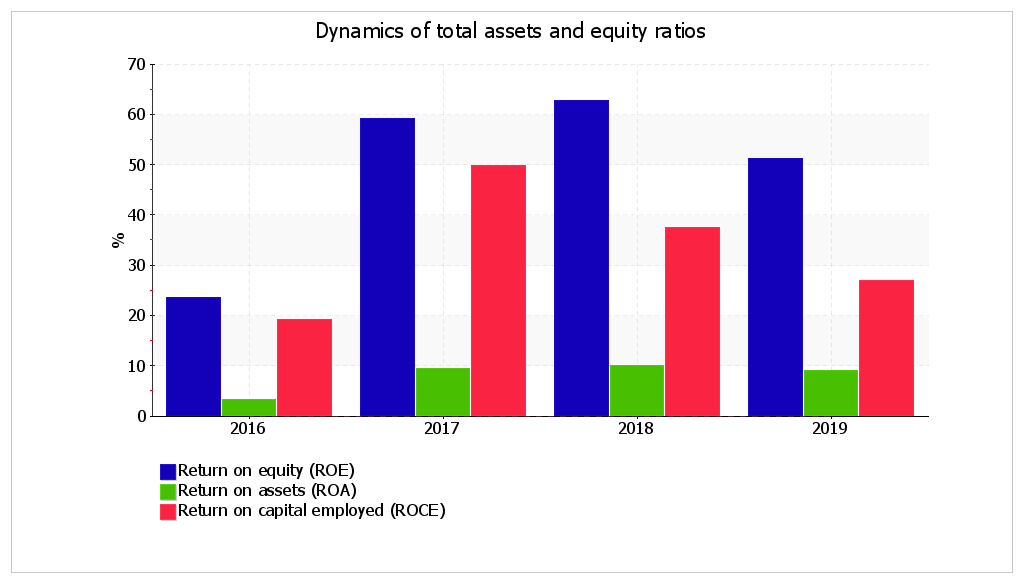

| Profitability ratios | Value, % | Change (col.5 - col.2) |

Description of the ratio and its reference value | |||

| 2016 | 2017 | 2018 | 2019 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Return on equity (ROE) | 23.6 | 59.2 | 62.7 | 51.1 | +27.5 | ROE is calculated by taking a year's worth of earnings (net profit) and dividing them by the average shareholder equity for that period, and is expressed as a percentage. It is one of the most important financial ratios and profitability metrics. Acceptable value: no less than 12%. |

| Return on assets (ROA) | 3.3 | 9.4 | 10 | 9 | +5.7 | ROA is calculated by dividing net income by total assets, and displayed as a percentage. Normal value: no less than 6%. |

| Return on capital employed (ROCE) | 19.2 | 49.8 | 37.5 | 27 | +7.8 | ROCE is calculated by dividing EBIT by capital employed (equity plus non-current liabilities). It indicates the efficiency and profitability of a company's capital investments. |

During the period from 01.01.2019 to 31.12.2019, the return on assets amounted to 9%; that is much higher (+5.7%) than for the year 2016. At the beginning of the analysed period, the return on assets was not normal, but later it was.

One of the most important ratio of business profitability is the return on equity (ROE), which reflects the profitability of investments by the owners. During the year 2019, a return on equity was 51.1% per annum. And it should be observed that such a high return on equity is a result of a low percentage of own capital (equity) of the total company's capital (19.9%).

The chart below shows changes of the main rates of return on assets and equity of the company for the period reviewed (from 31 December, 2015 to 31 December, 2019).

Further in the table, the calculated rates of turnover of assets and liabilities describe how fast prepaid assets and liabilities to suppliers, contractors and staff are effected. Turnover ratios have strong industry specifics and depend on activity. This is why an absolute value of the ratios does not permit making a qualitative assessment. When assets turnover ratios are analysed, an increase in ratios (i.e. velocity of circulation) and a reduction in circulation days are deemed to be positive dynamics. There is no well-defined interaction for accounts payable and capital turnover. In any case, an accurate conclusion can only be made after the reasons that caused these changes are considered.

| Turnover ratio | Value, days | Ratio 2016 |

Ratio 2019 |

Change, days (col.5 - col.2) |

|||

| 2016 | 2017 | 2018 | 2019 | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Receivables turnover (days sales outstanding) (average trade and other current receivables divided by average daily revenue*) |

67 | 46 | 36 | 27 | 5.5 | 13.5 | -40 |

| Accounts payable turnover (days payable outstanding) (average current payables divided by average daily purchases) |

35 | 39 | 50 | 45 | 10.4 | 8.1 | +10 |

| Inventory turnover (days inventory outstanding) (average inventory divided by average daily cost of sales) |

4 | 3 | 4 | 4 | 92.5 | 82.1 | – |

| Asset turnover (average total assets divided by average daily revenue) |

125 | 104 | 137 | 153 | 2.9 | 2.4 | +28 |

| Current asset turnover (average current assets divided by average daily revenue) |

117 | 90 | 112 | 117 | 3.1 | 3.1 | – |

| Capital turnover (average equity divided by average daily revenue) |

17 | 17 | 22 | 27 | 21 | 13.6 | +10 |

| Reference: Cash conversion cycle (days sales outstanding + days inventory outstanding - days payable outstanding) |

35 | 10 | -11 | -13 | x | x | -48 |

During the year 2019, the average collection period (Days Sales Outstanding) was 27 days and the average days payable outstanding was 45 days as shown in the table. The rate of asset turnover means that Goldstar gains revenue equal to the sum of all the available assets every 130 days (on average for the period analysed (from 31.12.2015 to 31.12.2019)).

The most important indicators of Goldstar's financial state and activity results are summarized below by using a qualitative assessment during the 4 years.

There are the following excellent financial indicators:

Such characteristics describe the financial condition of Goldstar relative a good standard:

The following indicators describe the Goldstar's financial state from a negative point of view:

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The following conclusions were made based on a qualitative assessment of the rates at the end of the period analysed, their dynamics during the period and the forecast for the next year. Scores of the financial position and activity results for Goldstar were +0.16 and +1.75, respectively, i.e. the financial position is characterized as normal; the financial results are described as excellent for the entire period reviewed. These two scores were used to calculate the final rating score of the company's financial condition, which made A (good condition).

An "A" rating shows a good financial condition of a company and its' capability to meet their likely current liabilities. Companies with this rating refer to the category of the borrowers who can obtain credits with high probability (good creditworthiness).

The Altman Z-score calculated below as one of the rates of probable bankruptcy of the company (a 5-factor model for private manufacturing firms is taken for Goldstar):

Z-score = 0.717T1 + 0.847T2 + 3.107T3 + 0.42T4 + 0.998T5 , where

| Ratio | Calculation | Ratio value on 31.12.2019 | Weighting factor | Product (col. 3 x col. 4) |

| 1 | 2 | 3 | 4 | 5 |

| T1 | Working Capital / Total Assets | +0.22 | 0.717 | +0.16 |

| T2 | Retained Earnings / Total Assets | +0.2 | 0.847 | +0.17 |

| T3 | Earnings Before Interest and Taxes / Total Assets | +0.13 | 3.107 | +0.41 |

| T4 | Equity / Total Liabilities | +0.25 | 0.42 | +0.1 |

| T5 | Sales / Total Assets | +2.26 | 0.998 | +2.25 |

| Altman Z-score: | +3.08 | |||

Discrimination ranges:

Goldstar's Z-score was 3.08 on 31.12.2019. Such a value says about the insignificant probability of Goldstar's bankruptcy.

Another bankruptcy forecast algorithm is Taffler Model, which has the following formula:

Z = 0,53X1 + 0,13X2 + 0,18X3 + 0,16X4 , where

| Ratio | Calculation | Ratio value on 31.12.2019 | Weighting factor | Product (col. 3 х col. 4) |

| 1 | 2 | 3 | 4 | 5 |

| X1 | Profit before tax / Current liabilities | 0.37 | 0,53 | 0.2 |

| X2 | Current assets / Total liabilities | 0.88 | 0,13 | 0.11 |

| X3 | Current liabilities / Total assets | 0.49 | 0,18 | 0.09 |

| X4 | Revenue from sales / Total assets | 2.26 | 0,16 | 0.36 |

| Taffler Z-score: | 0.76 | |||

Function values are interpreted as follows:

Final score according to Taffler Model is 0.76. So there is a low probability of bankruptcy risk.

| Ratio | Weighting factor | Score | Average score (col.3 x 0.25 + col.4 x 0.6 + col.5 x 0.15) |

Weighted average score (col.2 x col.6) |

||

| past | present | future | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| I. Rating of the company's financial position | ||||||

| Debt ratio | 0.3 | -1 | -1 | -1 | -1 | -0.3 |

| Non-current assets to net worth | 0.15 | +2 | -1 | -1 | -0.25 | -0.038 |

| Current ratio | 0.2 | -1 | -1 | -1 | -1 | -0.2 |

| Quick ratio | 0.2 | +2 | +2 | +2 | +2 | +0.4 |

| Cash ratio | 0.15 | +2 | +2 | +2 | +2 | +0.3 |

| Total | 1 | Final score (in total col.7 : col. 2): | +0.162 | |||

| II. Rating of the company's financial performance | ||||||

| Return on equity (ROE) | 0.5 | +2 | +2 | +2 | +2 | +1 |

| Return on assets (ROA) | 0.3 | +1 | +1 | +2 | +1.15 | +0.345 |

| Sales growth | 0.2 | +2 | +2 | +2 | +2 | +0.4 |

| Total | 1 | Final score (in total col.7 : col. 2): | +1.745 | |||

Final rating score for Goldstar's financial condition: (+0.162 x 0,6) + (+1.745 x 0,4) = +0.8 (A - good)

Reference: Financial condition scale

| Total score | Sign | The qualitative assessment of a financial condition | |

| from |

to (inclusive) |

||

| 2 | 1.6 | AAA | Excellent |

| 1.6 | 1.2 | AA | Very good |

| 1.2 | 0.8 | A | Good |

| 0.8 | 0.4 | BBB | Positive |

| 0.4 | 0 | BB | Normal |

| 0 | -0.4 | B | Satisfactory |

| -0.4 | -0.8 | CCC | Unsatisfactory |

| -0.8 | -1.2 | CC | Adverse |

| -1.2 | -1.6 | C | Bad |

| -1.6 | -2 | D | Critical |